Aetna Inc, the No. 3 U.S. health insurer, said on Thursday it has decided not to sell insurance on New York's individual health insurance exchange, part of the country's healthcare reform.

Reported by Newsmax 17 hours ago.

Aetna Pulls out of New York Health Insurance Exchange

↧

↧

The Jordan Insurance Agency Announces to Offer Economical Health and Life Insurance Plans

The Charlotte-based Insurance Agency offers various health insurance plans and life insurance plans at affordable rates according to the needs of a diverse range of clients in collaboration with a number of other insurance carriers.The Jordan Insurance Agency announces to offer affordable health insurance and life insurance policies in Charlotte, North Carolina. The health insurance plans cover a wide range of policies such as individual health insurance, short term medical, indemnity insurance, health savings account, small group insurance, and medicare supplement. Each of these plans is unique and is suitable for different kinds of clients.

The Jordan insurance agency is not just an insurance agency which offers a horde of policies and plans, but it works in collaboration with a number of insurance carriers to find the right plan for the client, according to their needs and lifestyle.

The spokesperson of the company has this to say about the objective of the agency, "At our company we don't just sell insurance policies; we build lasting relationships with our clients. We provide the best service in town. We work with some of the best carriers in town, in order to serve the varied needs of our clients. We specialize in life insurance and health insurance plans. However, in addition to these we offer supplemental insurance like dental insurance, vision insurance and accidental insurance. We also offer small business insurance."

He adds saying, "We offer the best coverage plans at the lowest possible price. We have been helping people in the vicinity of Charlotte for about seven years."

The company offers supplemental insurance like accident insurance, dental insurance, vision insurance and critical illness insurance. They also provide small business insurance like defined contribution plan.

About the Company:

The Jordan Insurance Agency is an insurance agency located in Charlotte, North Carolina that provides clients with the type of insurance policies they need according to their varying needs and guarantees the best coverage at the lowest price. To know more about this Charlotte insurance agency, visit http://thejordaninsuranceagency.com/

###

Company Contact Information

The Jordan Insurance Agency

Billy Jordan, Jr.

13860 Ballantyne Corporate Place Suite 120 A

28277

704-926-7565

News and Press Release Distribution From I-Newswire.com Reported by i-Newswire.com 17 hours ago.

The Jordan insurance agency is not just an insurance agency which offers a horde of policies and plans, but it works in collaboration with a number of insurance carriers to find the right plan for the client, according to their needs and lifestyle.

The spokesperson of the company has this to say about the objective of the agency, "At our company we don't just sell insurance policies; we build lasting relationships with our clients. We provide the best service in town. We work with some of the best carriers in town, in order to serve the varied needs of our clients. We specialize in life insurance and health insurance plans. However, in addition to these we offer supplemental insurance like dental insurance, vision insurance and accidental insurance. We also offer small business insurance."

He adds saying, "We offer the best coverage plans at the lowest possible price. We have been helping people in the vicinity of Charlotte for about seven years."

The company offers supplemental insurance like accident insurance, dental insurance, vision insurance and critical illness insurance. They also provide small business insurance like defined contribution plan.

About the Company:

The Jordan Insurance Agency is an insurance agency located in Charlotte, North Carolina that provides clients with the type of insurance policies they need according to their varying needs and guarantees the best coverage at the lowest price. To know more about this Charlotte insurance agency, visit http://thejordaninsuranceagency.com/

###

Company Contact Information

The Jordan Insurance Agency

Billy Jordan, Jr.

13860 Ballantyne Corporate Place Suite 120 A

28277

704-926-7565

News and Press Release Distribution From I-Newswire.com Reported by i-Newswire.com 17 hours ago.

↧

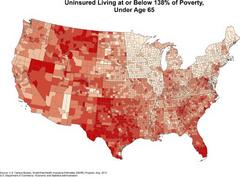

Census Bureau Releases Health Insurance Coverage Estimates for All Counties

WASHINGTON, Aug. 29, 2013 /PRNewswire-USNewswire/ -- The Census Bureau today released its 2011 Small Area Health Insurance Estimates (SAHIE). The estimates show the number of people with and without health insurance for all states and each of the nation's roughly 3,140 counties. The...

Reported by PR Newswire 16 hours ago.

WASHINGTON, Aug. 29, 2013 /PRNewswire-USNewswire/ -- The Census Bureau today released its 2011 Small Area Health Insurance Estimates (SAHIE). The estimates show the number of people with and without health insurance for all states and each of the nation's roughly 3,140 counties. The...

Reported by PR Newswire 16 hours ago.

↧

California unveils ad campaign for new health insurance market

California lifted the curtain Thursday on its advertising for a new health insurance marketplace opening this fall as part of the federal health law.

Reported by L.A. Times 13 hours ago.

↧

Nearly a quarter of younger New Mexicans don’t have health insurance

New Mexico has the fourth-highest percentage of residents without health insurance, the U.S. Census Bureau said Thursday. In 2011, 405,848 New Mexico residents younger than 65, or 23 percent, didn’t have insurance, the Census Bureau said. Only Texas, Florida and Nevada had higher uninsured rates. In Texas, nearly 5.8 million people, or 25.7 percent of the population younger than 65, had no health insurance. Florida’s uninsured rate was 24.8 percent, with 3.8 million residents going without…

Reported by bizjournals 12 hours ago.

↧

↧

America’s Health Insurance Announces In-Person Assistance in Enrolling Consumers through the Federally-Facilitated Marketplace

As concerns arise over the security of sensitive information being handled by federally-appointed “navigators,” America’s Health Insurance is partnering with Anthem to set up booths in pharmacies for consumers to receive in-person, one-on-one, assistance from reliable licensed agents.

Fort Wayne, IN (PRWEB) August 29, 2013

Headlines such as Forbes, Who are Obamacare Navigators and Will They Steal Your Identity?, are filtering through the news-waves this week. NPR reported that Florida was balking at using navigators because of the lack of control over navigators stealing data and personal information from the consumers they are counseling. In an article written on August 26th, the West Virginia Attorney General Patrick Morrisey addresses the concern that the navigator program may expose the nation's citizens to identity thieves. He was quoted stating that “Obamacare is a bonanza for thieves.” GOP Rep. Diane Black of Tennessee wrote a letter to Health and Human Services Secretary Kathleen Sebelius indicating her concern over the reduction in training for navigators from thirty hours to twenty hours. The notion of under-qualified, lightly trained navigators is raising concerns of the security of consumer information and quality of service to consumers.

On the contrary, a recent study by the University of Minnesota found that when agents or brokers are involved in shopping for health insurance coverage, it is more likely that firms and individuals will purchase coverage at a lower price because of the increasing agent/broker competition. Agents and brokers are required by state laws to be trained, licensed, and are highly responsible for the security of personal information, such as social security numbers, health records, etc, through privacy acts.

America’s Health Insurance has invested hundreds of man hours to comprehend the depth of the Affordable Care Act law, and how it will affect their current and future customers. They are currently in training to become a registered and certified agent in the Federally-Facilitated Marketplace. Insurance agents and brokers have track records of extensive training, protecting the privacy of clients and prospects, and the knowledge of health insurance products that will benefit consumers. America’s Health Insurance feels they are obligated to do everything they can to uphold their core beliefs that consumers are entitled to the best plans at the best prices.

America’s Health Insurance is partnering with Anthem to set up booths in stores like Kroger, Wal-Mart, and Sam’s Club to help consumers evaluate their options and purchase coverage in the exchange from an educated and experienced licensed agent. America’s Health Insurance agents will be setting up their first booth at the Chestnut Hills Kroger pharmacy in Fort Wayne, Indiana—10230 Chestnut Plaza Dr—between the dates of October 1, 2013 through December 7, 2013. This initiative is designed to help consumers receive every benefit and opportunity that the Affordable Care Act presents to individuals.

For more information, America’s Health Insurance can be reached at 888-589-3000, or http://www.ahifw.com.

America’s Health Insurance is a nation-wide health insurance agency located in Fort Wayne, Indiana. They are one of the top three health insurance producers in America. As the Affordable Care Act approaches, they are working innovatively to bring the best possible health care coverage for their clients. They have a strong relationship with the top insurance carriers in the country, which enables them to be on top of the health insurance market. This allows them to provide the absolute best products for their clients. Reported by PRWeb 10 hours ago.

Fort Wayne, IN (PRWEB) August 29, 2013

Headlines such as Forbes, Who are Obamacare Navigators and Will They Steal Your Identity?, are filtering through the news-waves this week. NPR reported that Florida was balking at using navigators because of the lack of control over navigators stealing data and personal information from the consumers they are counseling. In an article written on August 26th, the West Virginia Attorney General Patrick Morrisey addresses the concern that the navigator program may expose the nation's citizens to identity thieves. He was quoted stating that “Obamacare is a bonanza for thieves.” GOP Rep. Diane Black of Tennessee wrote a letter to Health and Human Services Secretary Kathleen Sebelius indicating her concern over the reduction in training for navigators from thirty hours to twenty hours. The notion of under-qualified, lightly trained navigators is raising concerns of the security of consumer information and quality of service to consumers.

On the contrary, a recent study by the University of Minnesota found that when agents or brokers are involved in shopping for health insurance coverage, it is more likely that firms and individuals will purchase coverage at a lower price because of the increasing agent/broker competition. Agents and brokers are required by state laws to be trained, licensed, and are highly responsible for the security of personal information, such as social security numbers, health records, etc, through privacy acts.

America’s Health Insurance has invested hundreds of man hours to comprehend the depth of the Affordable Care Act law, and how it will affect their current and future customers. They are currently in training to become a registered and certified agent in the Federally-Facilitated Marketplace. Insurance agents and brokers have track records of extensive training, protecting the privacy of clients and prospects, and the knowledge of health insurance products that will benefit consumers. America’s Health Insurance feels they are obligated to do everything they can to uphold their core beliefs that consumers are entitled to the best plans at the best prices.

America’s Health Insurance is partnering with Anthem to set up booths in stores like Kroger, Wal-Mart, and Sam’s Club to help consumers evaluate their options and purchase coverage in the exchange from an educated and experienced licensed agent. America’s Health Insurance agents will be setting up their first booth at the Chestnut Hills Kroger pharmacy in Fort Wayne, Indiana—10230 Chestnut Plaza Dr—between the dates of October 1, 2013 through December 7, 2013. This initiative is designed to help consumers receive every benefit and opportunity that the Affordable Care Act presents to individuals.

For more information, America’s Health Insurance can be reached at 888-589-3000, or http://www.ahifw.com.

America’s Health Insurance is a nation-wide health insurance agency located in Fort Wayne, Indiana. They are one of the top three health insurance producers in America. As the Affordable Care Act approaches, they are working innovatively to bring the best possible health care coverage for their clients. They have a strong relationship with the top insurance carriers in the country, which enables them to be on top of the health insurance market. This allows them to provide the absolute best products for their clients. Reported by PRWeb 10 hours ago.

↧

Major Insurance Company Pulls Out Of Obamacare Measure

By Caroline Humer

Aug 29 (Reuters) - Aetna Inc has decided not to sell insurance on New York's individual health insurance exchange, which is being created under President Barack Obama's healthcare reform law, the fifth state where it has reversed course in recent weeks.

The third-largest U.S. health insurer has said it is seeking to limit its exposure to the risks of providing health plans to America's uninsured, but did not give details about its decision to pull out of specific markets.

"We believe it is critical that our plans not only be competitive, but also financially viable, in order to meet the long-term needs of the exchanges in which we choose to participate. On New York, as a result of our analysis, we reluctantly came to the conclusion to withdraw," Aetna spokeswoman Cynthia Michener said.

The New York decision comes as states finalize the roster of health plans that will be offered to millions of uninsured Americans beginning on Oct. 1.

Aetna and its newly acquired Coventry Health unit, a low-cost provider that caters to individuals and Medicaid beneficiaries and provides private Medicare policies, still have applications to sell coverage in 10 states, based on publicly available information.

Michener said the full list of state exchanges where Aetna will participate is still being finalized.

The new online insurance exchanges are the lynchpin of Obama's healthcare reform, representing a massive technology build-out that has run up against multiple delays and political opposition in many states. In their first year, the exchanges aim to provide coverage to 7 million uninsured Americans, many of whom will be eligible for government subsidies.

Aetna's large competitors, such as UnitedHealth Group Inc and WellPoint Inc, have also planned limited entries into the new exchanges while they wait and see whether they operate smoothly and whether enough healthy people sign on to offset the costs of sicker new members.

"We've got this period where the exchange experience, the exchange sentiment, and news headlines are probably not going to be very flattering and that's not going to have a positive impact on turnout," said Jefferies & Co analyst David Windley.

"Longer-term, those kinks will get ironed out, more people will get comfortable and in (the next few years) more people will be accessing their health insurance through an exchange of some sort," he said.

'RISK-BASED APPROACH'

Aetna signaled last month that it was considering withdrawing some applications because of its purchase of Coventry, which also had filed documents to sell insurance plans on exchanges around the country.

"We have taken a prudent risk-based approach to both our overall exposure and exposure within a given marketplace," Chief Executive Officer Mark Bertolini said on a conference call with analysts at the time.

Since then, it has withdrawn applications in Maryland, Ohio, Georgia, and Connecticut, where it is based. In Maryland, Aetna's decision came after state regulators ordered the company to lower rates dramatically from what it had proposed.

Aetna also has filed applications in Florida, Arizona and Virginia, where the federal government will operate the exchanges, and in Washington, D.C., which is running its own exchange.

Coventry filed applications to sell insurance in Florida, Iowa, Kansas, Louisiana, Nebraska, North Carolina, Ohio and Virginia, according to those states' insurance departments. Iowa is working with the government on its exchanges while the rest are being run entirely by the federal government.

Coventry withdrew its applications in Georgia and Maryland when Aetna bowed out but it remains in Ohio. It also withdrew earlier this month from Tennessee.

Aetna and Coventry may also have filed plans in other states that have not released any information about participants.

Insurance plans in the 33 states that have defaulted to the federal government exchanges must be approved by the Department of Health and Human Services (HHS), and then insurers sign off on them. Earlier this week, HHS delayed the sign-off deadline to mid-September after originally aiming for early next month.

Michener said the company will continue to serve small business and large business customers in New York and will offer products to individual consumers outside of the exchanges.

Only 17,000 or so people in New York currently buy individual insurance, but the exchange is expected to bring in 1 million people during the first three years. The exchange announced insurance participants on Aug. 20. Aetna was not on the list. Reported by Huffington Post 9 hours ago.

Aug 29 (Reuters) - Aetna Inc has decided not to sell insurance on New York's individual health insurance exchange, which is being created under President Barack Obama's healthcare reform law, the fifth state where it has reversed course in recent weeks.

The third-largest U.S. health insurer has said it is seeking to limit its exposure to the risks of providing health plans to America's uninsured, but did not give details about its decision to pull out of specific markets.

"We believe it is critical that our plans not only be competitive, but also financially viable, in order to meet the long-term needs of the exchanges in which we choose to participate. On New York, as a result of our analysis, we reluctantly came to the conclusion to withdraw," Aetna spokeswoman Cynthia Michener said.

The New York decision comes as states finalize the roster of health plans that will be offered to millions of uninsured Americans beginning on Oct. 1.

Aetna and its newly acquired Coventry Health unit, a low-cost provider that caters to individuals and Medicaid beneficiaries and provides private Medicare policies, still have applications to sell coverage in 10 states, based on publicly available information.

Michener said the full list of state exchanges where Aetna will participate is still being finalized.

The new online insurance exchanges are the lynchpin of Obama's healthcare reform, representing a massive technology build-out that has run up against multiple delays and political opposition in many states. In their first year, the exchanges aim to provide coverage to 7 million uninsured Americans, many of whom will be eligible for government subsidies.

Aetna's large competitors, such as UnitedHealth Group Inc and WellPoint Inc, have also planned limited entries into the new exchanges while they wait and see whether they operate smoothly and whether enough healthy people sign on to offset the costs of sicker new members.

"We've got this period where the exchange experience, the exchange sentiment, and news headlines are probably not going to be very flattering and that's not going to have a positive impact on turnout," said Jefferies & Co analyst David Windley.

"Longer-term, those kinks will get ironed out, more people will get comfortable and in (the next few years) more people will be accessing their health insurance through an exchange of some sort," he said.

'RISK-BASED APPROACH'

Aetna signaled last month that it was considering withdrawing some applications because of its purchase of Coventry, which also had filed documents to sell insurance plans on exchanges around the country.

"We have taken a prudent risk-based approach to both our overall exposure and exposure within a given marketplace," Chief Executive Officer Mark Bertolini said on a conference call with analysts at the time.

Since then, it has withdrawn applications in Maryland, Ohio, Georgia, and Connecticut, where it is based. In Maryland, Aetna's decision came after state regulators ordered the company to lower rates dramatically from what it had proposed.

Aetna also has filed applications in Florida, Arizona and Virginia, where the federal government will operate the exchanges, and in Washington, D.C., which is running its own exchange.

Coventry filed applications to sell insurance in Florida, Iowa, Kansas, Louisiana, Nebraska, North Carolina, Ohio and Virginia, according to those states' insurance departments. Iowa is working with the government on its exchanges while the rest are being run entirely by the federal government.

Coventry withdrew its applications in Georgia and Maryland when Aetna bowed out but it remains in Ohio. It also withdrew earlier this month from Tennessee.

Aetna and Coventry may also have filed plans in other states that have not released any information about participants.

Insurance plans in the 33 states that have defaulted to the federal government exchanges must be approved by the Department of Health and Human Services (HHS), and then insurers sign off on them. Earlier this week, HHS delayed the sign-off deadline to mid-September after originally aiming for early next month.

Michener said the company will continue to serve small business and large business customers in New York and will offer products to individual consumers outside of the exchanges.

Only 17,000 or so people in New York currently buy individual insurance, but the exchange is expected to bring in 1 million people during the first three years. The exchange announced insurance participants on Aug. 20. Aetna was not on the list. Reported by Huffington Post 9 hours ago.

↧

How to pick a health insurance plan

*How to pick a health insurance plan*

Health care can be very expensive. It costs about $9,000 to have a baby, and the average hospital stay costs $30,000. Health insurance is a way to reduce those costs to an amount that you can manage by sharing the risk with others. That works because most people are mostly healthy most of the time, so their premiums help pay for the expenses of the small number who are sick or injured.

Here are the three major categories you need to consider when picking a plan.

Before health reform, companies could sell plans that didn’t cover all types of medical care. They might not cover doctor visits, or prescription drugs, or maternity care.

This was bad for consumers because no one can predict what kind of medical care they may need in the future. The only way to protect yourself financially is to have health insurance that covers every kind of health care.

*The new health care law has fixed this problem.*

Insurance sold to individuals and small businesses must now cover 10 “essential health benefits."

· Emergency services

· Hospitalization

· Laboratory tests

· Maternity and newborn care

· Mental health and substance abuse treatment

· Dental and vision care for children

· Outpatient care (doctors and other services you receive outside of a hospital)

· Prescription drugs

· Preventive services (such as immunizations and mammograms)

· Rehabilitation services

The rules for insurance provided by large employers are a little different but most of them will cover the same set of benefits. To make sure, ask your employer for the Summary of Benefits and Coverage, a standard form that will state exactly what the plan covers and doesn't cover.

* *

Get health insurance rankings

Click on the image at right for rankings of health insurance plans nationwide. Use the tool to:

· Choose a plan category such as private HMO or PPO, or Medicare HMO or PPO.

· Choose a state.

· Customize your search to compare plans' scores and their performance in measures such as consumer satisfaction and providing preventive services.

You pay for health insurance in two ways:

· The monthly premium that you pay to purchase your plan.

· The share of costs you pay out of your own pocket when you receive medical care. Those are some combination of deductibles, coinsurance, and copays.

In general, if you pay a higher premium upfront you will pay less when you receive medical care, and vice versa.

To make comparison easier, the plans sold in state Marketplaces will be in standardized “metal tiers” with various combinations of premiums and cost-sharing:

· Bronze plans will cover, on average, 60 percent of the average member's total health care costs

· Silver plans will cover 70 percent.

· Gold plans will cover 80 percent.

· Platinum plans will cover 90 percent.

Which of those plans is right for you depends on your health and your fiancial situation:

· If you already know you have an expensive medical condition, consider a plan with a higher premium that covers more of your costs.

· If you are generally healthy you might come out ahead paying a lower premium and a bigger share of your health costs, because those costs are most likely not going to be that high. Of course, if you need to be prepared to pay more if you do unexpectedly become sick or injured.

-*Your out-of-pocket expenses*-

The terms “cost-sharing” or “out-of-pocket costs” refer to the proportion of your medical bills you will be responsible for paying when you actually receive health care. Cost-sharing never includes your monthly premium.

If you buy insurance through your state Marketplace, you’ll be able to see and compare the cost-sharing structure of plans before you buy. If you get insurance through a job, the information will be on the Summary of Benefits and Coverage form.

These are the four cost-sharing terms you will see:

*Deductible. *The amount you pay every year before the insurance company starts paying its share of the costs. In every plan you can buy, preventive services will be covered in full even if you haven’t used up your deductible for the year. Some plans will also pay a portion of your costs for a few other services, usually doctor visits and prescription drugs, even before your deductible has been met. In general plans with higher premiums have lower deductibles, and vice versa.

*Copay. *A fixed dollar amount you pay for certain types of care. You might pay a $20 for a doctor visit and the insurance company will pick up the rest. Plans with higher premiums generally have lower copays, and vice versa. And some plans do not have copays at all. They use other methods of cost-sharing.

*Coinsurance. *A percentage of the cost of your medical care. For an MRI that costs $1,000 you might pay you might pay 20% ($200). Your insurance company will pay the other 80% ($800). Plans with higher premiums generally pick up a larger portion of the bill.

*Out-of-pocket limit. *The most cost-sharing you will ever have to pay in a year. It is the total of your deductible, copays, and coinsurance (but does not include your premiums). Once you hit this limit, the insurance company will pick up 100% of your costs for the remainder of the year. Most people never pay enough cost-sharing to hit the out-of-pocket limit but it can happen if you require a lot of costly treatment for a serious accident or illness. Plans with higher premiums generally have lower out-of-pocket limits.

The new health law says that in 2014, the out-of-pocket limit for plans sold to individuals and small groups cannot be more than:

· $6,350 for an individual

· $12,700 for a family

Some plans may have lower out-of-pocket limits than that.

Every health insurance plan has a network of providers—doctors, hospitals, laboratories, imaging centers, and pharmacies that have signed contracts with the insurance company agreeing to provide their services to plan members at a specific price.

If a doctor is not in your plan's network, the insurance company may not cover the bill, or may ask you to pay a much higher share of the cost. So if you have doctors you want to continue to see, they need to be in the plan's network.

If you are shopping in a Marketplace you can see the plan's provider directory before you buy.

If you are considering insurance through a job, you can obtain provider lists from participating insurance companies, or from the company’s employee benefits department.

*Consumer Reports has no relationship with any advertisers or sponsors on this website. Copyright © 2007-2013 Consumers Union of U.S.*

*Subscribe now!*

Subscribe to *ConsumerReports.org* for expert Ratings, buying advice and reliability on hundreds of products.

--------------------

Update your feed preferences Reported by Consumer Reports 7 hours ago.

Health care can be very expensive. It costs about $9,000 to have a baby, and the average hospital stay costs $30,000. Health insurance is a way to reduce those costs to an amount that you can manage by sharing the risk with others. That works because most people are mostly healthy most of the time, so their premiums help pay for the expenses of the small number who are sick or injured.

Here are the three major categories you need to consider when picking a plan.

Before health reform, companies could sell plans that didn’t cover all types of medical care. They might not cover doctor visits, or prescription drugs, or maternity care.

This was bad for consumers because no one can predict what kind of medical care they may need in the future. The only way to protect yourself financially is to have health insurance that covers every kind of health care.

*The new health care law has fixed this problem.*

Insurance sold to individuals and small businesses must now cover 10 “essential health benefits."

· Emergency services

· Hospitalization

· Laboratory tests

· Maternity and newborn care

· Mental health and substance abuse treatment

· Dental and vision care for children

· Outpatient care (doctors and other services you receive outside of a hospital)

· Prescription drugs

· Preventive services (such as immunizations and mammograms)

· Rehabilitation services

The rules for insurance provided by large employers are a little different but most of them will cover the same set of benefits. To make sure, ask your employer for the Summary of Benefits and Coverage, a standard form that will state exactly what the plan covers and doesn't cover.

* *

Get health insurance rankings

Click on the image at right for rankings of health insurance plans nationwide. Use the tool to:

· Choose a plan category such as private HMO or PPO, or Medicare HMO or PPO.

· Choose a state.

· Customize your search to compare plans' scores and their performance in measures such as consumer satisfaction and providing preventive services.

You pay for health insurance in two ways:

· The monthly premium that you pay to purchase your plan.

· The share of costs you pay out of your own pocket when you receive medical care. Those are some combination of deductibles, coinsurance, and copays.

In general, if you pay a higher premium upfront you will pay less when you receive medical care, and vice versa.

To make comparison easier, the plans sold in state Marketplaces will be in standardized “metal tiers” with various combinations of premiums and cost-sharing:

· Bronze plans will cover, on average, 60 percent of the average member's total health care costs

· Silver plans will cover 70 percent.

· Gold plans will cover 80 percent.

· Platinum plans will cover 90 percent.

Which of those plans is right for you depends on your health and your fiancial situation:

· If you already know you have an expensive medical condition, consider a plan with a higher premium that covers more of your costs.

· If you are generally healthy you might come out ahead paying a lower premium and a bigger share of your health costs, because those costs are most likely not going to be that high. Of course, if you need to be prepared to pay more if you do unexpectedly become sick or injured.

-*Your out-of-pocket expenses*-

The terms “cost-sharing” or “out-of-pocket costs” refer to the proportion of your medical bills you will be responsible for paying when you actually receive health care. Cost-sharing never includes your monthly premium.

If you buy insurance through your state Marketplace, you’ll be able to see and compare the cost-sharing structure of plans before you buy. If you get insurance through a job, the information will be on the Summary of Benefits and Coverage form.

These are the four cost-sharing terms you will see:

*Deductible. *The amount you pay every year before the insurance company starts paying its share of the costs. In every plan you can buy, preventive services will be covered in full even if you haven’t used up your deductible for the year. Some plans will also pay a portion of your costs for a few other services, usually doctor visits and prescription drugs, even before your deductible has been met. In general plans with higher premiums have lower deductibles, and vice versa.

*Copay. *A fixed dollar amount you pay for certain types of care. You might pay a $20 for a doctor visit and the insurance company will pick up the rest. Plans with higher premiums generally have lower copays, and vice versa. And some plans do not have copays at all. They use other methods of cost-sharing.

*Coinsurance. *A percentage of the cost of your medical care. For an MRI that costs $1,000 you might pay you might pay 20% ($200). Your insurance company will pay the other 80% ($800). Plans with higher premiums generally pick up a larger portion of the bill.

*Out-of-pocket limit. *The most cost-sharing you will ever have to pay in a year. It is the total of your deductible, copays, and coinsurance (but does not include your premiums). Once you hit this limit, the insurance company will pick up 100% of your costs for the remainder of the year. Most people never pay enough cost-sharing to hit the out-of-pocket limit but it can happen if you require a lot of costly treatment for a serious accident or illness. Plans with higher premiums generally have lower out-of-pocket limits.

The new health law says that in 2014, the out-of-pocket limit for plans sold to individuals and small groups cannot be more than:

· $6,350 for an individual

· $12,700 for a family

Some plans may have lower out-of-pocket limits than that.

Every health insurance plan has a network of providers—doctors, hospitals, laboratories, imaging centers, and pharmacies that have signed contracts with the insurance company agreeing to provide their services to plan members at a specific price.

If a doctor is not in your plan's network, the insurance company may not cover the bill, or may ask you to pay a much higher share of the cost. So if you have doctors you want to continue to see, they need to be in the plan's network.

If you are shopping in a Marketplace you can see the plan's provider directory before you buy.

If you are considering insurance through a job, you can obtain provider lists from participating insurance companies, or from the company’s employee benefits department.

*Consumer Reports has no relationship with any advertisers or sponsors on this website. Copyright © 2007-2013 Consumers Union of U.S.*

*Subscribe now!*

Subscribe to *ConsumerReports.org* for expert Ratings, buying advice and reliability on hundreds of products.

--------------------

Update your feed preferences Reported by Consumer Reports 7 hours ago.

↧

Yasmina Vinci: Sequestration Impairs Futures of At-Risk Children

This week, I was energized by a panel of early childhood education experts, stakeholders, and parents who were gathered in Washington, DC to discuss the critical role Head Start plays in creating opportunity for America's most vulnerable children. Though the discussion was anchored by a recognition of the vastly positive influence Head Start has on the lives of millions of our nation's youngest learners, the conversation centered on the devastating, downstream impacts of the federally-mandated budget cuts. Each spoke movingly about the devastating effects of sequester and emphasized the critical importance of investing in early childhood education. To a person, there was an impassioned call for investments in early learning that studies have shown deliver results for at-risk children.

It's an auspicious time for us to be thinking about ensuring that all children have access to great opportunities. Is there anyone who hasn't been moved by the celebrations this week of the 50th Anniversary of the March on Washington? As a nation, we reflected on a breathtakingly important moment in our nation's history -- the joy of knowing how far we've come and a stark reminder of how far we still have to go. I'm proud of Head Start's thousands of staff across the country today who play their part to give all at-risk children a chance at a better life. And proud that the current pastor of Ebenezer Baptist Church - Dr. King's ministry - was himself a Head Start child.

In 2012, Head Start and Early Head Start programs across the country were serving a scant 40 percent of all eligible children. Our waiting lists were long, and over several years of flat funding with rising fixed costs in rent, energy, and health insurance, programs had already begun deferring maintenance, shrinking support staff, and lowering salaries. We have almost always operated at the margins, because it seems inconceivable not to spend every available dollar on providing the best possible quality program for every possible child.

So when the unthinkable happened, and sequestration became the new reality in March, we had little fat to cut. As a result, 57,000 fewer children will be able to attend Head Start this year, and many more vulnerable children are struggling to get the most from their Head Start experience in the many cases where critical core services were cut to limit enrollment reductions.

In fact, these data show that many programs reported cutting days from the school year, for a total of more than 1,342,000 days of service lost. Not only does this take away very critical days of early learning, but also puts parents and families in the difficult situation of finding quality, affordable child care options in order to maintain work.

If you asked me earlier this year what I would like to be talking about in 2013, my answer would not have been sequestration. Instead I would have mentioned the drumbeat of building acceptance among policymakers and citizens alike about the critical importance of investing in high-quality early education.

Health researchers have given us better and more concrete data on the effects of a healthy early childhood experience. I'm thrilled to see the think tanks in Washington paying more and more attention to this issue, and to find new allies and supporters in Congress every week. I'm overjoyed to be working with the business community on this issue, and to be talking about it as an issue of readiness for the future of our economic viability. There has never been a moment in history when national recognition of the value of early learning was this universal. Sequestration was a swift punch. It took the wind out of the sails of the millions affiliated with today's Head Start--our families, our staff, our volunteers, and our advocates. In the midst of this anxiety, our best champion, President Obama, announced his plans to propose massive new investments in high-quality early learning. This is what we should be talking about.

We have more data behind us now than ever before. We have more acceptance on the part of states and local communities behind us than ever before. But the stalemate over the budget and our lingering shock that sequestration has not been restored prevents us from diverting our attention to new initiatives while we are still cutting children from our programs.

In the end, the wise direction for early education is clear: investments matter greatly and they return much more for America in value than the initial cost. Adding to today's investments with smart strategies and leveraging productive partnerships will continue to deliver results and put vulnerable children on the path to success. Reported by Huffington Post 6 hours ago.

It's an auspicious time for us to be thinking about ensuring that all children have access to great opportunities. Is there anyone who hasn't been moved by the celebrations this week of the 50th Anniversary of the March on Washington? As a nation, we reflected on a breathtakingly important moment in our nation's history -- the joy of knowing how far we've come and a stark reminder of how far we still have to go. I'm proud of Head Start's thousands of staff across the country today who play their part to give all at-risk children a chance at a better life. And proud that the current pastor of Ebenezer Baptist Church - Dr. King's ministry - was himself a Head Start child.

In 2012, Head Start and Early Head Start programs across the country were serving a scant 40 percent of all eligible children. Our waiting lists were long, and over several years of flat funding with rising fixed costs in rent, energy, and health insurance, programs had already begun deferring maintenance, shrinking support staff, and lowering salaries. We have almost always operated at the margins, because it seems inconceivable not to spend every available dollar on providing the best possible quality program for every possible child.

So when the unthinkable happened, and sequestration became the new reality in March, we had little fat to cut. As a result, 57,000 fewer children will be able to attend Head Start this year, and many more vulnerable children are struggling to get the most from their Head Start experience in the many cases where critical core services were cut to limit enrollment reductions.

In fact, these data show that many programs reported cutting days from the school year, for a total of more than 1,342,000 days of service lost. Not only does this take away very critical days of early learning, but also puts parents and families in the difficult situation of finding quality, affordable child care options in order to maintain work.

If you asked me earlier this year what I would like to be talking about in 2013, my answer would not have been sequestration. Instead I would have mentioned the drumbeat of building acceptance among policymakers and citizens alike about the critical importance of investing in high-quality early education.

Health researchers have given us better and more concrete data on the effects of a healthy early childhood experience. I'm thrilled to see the think tanks in Washington paying more and more attention to this issue, and to find new allies and supporters in Congress every week. I'm overjoyed to be working with the business community on this issue, and to be talking about it as an issue of readiness for the future of our economic viability. There has never been a moment in history when national recognition of the value of early learning was this universal. Sequestration was a swift punch. It took the wind out of the sails of the millions affiliated with today's Head Start--our families, our staff, our volunteers, and our advocates. In the midst of this anxiety, our best champion, President Obama, announced his plans to propose massive new investments in high-quality early learning. This is what we should be talking about.

We have more data behind us now than ever before. We have more acceptance on the part of states and local communities behind us than ever before. But the stalemate over the budget and our lingering shock that sequestration has not been restored prevents us from diverting our attention to new initiatives while we are still cutting children from our programs.

In the end, the wise direction for early education is clear: investments matter greatly and they return much more for America in value than the initial cost. Adding to today's investments with smart strategies and leveraging productive partnerships will continue to deliver results and put vulnerable children on the path to success. Reported by Huffington Post 6 hours ago.

↧

↧

Washington second in nation in growth of uninsured

With about 16 percent of its residents uninsured, Washington state falls solidly in middie of the pack, with Texas having the highest percentage of residents without health insurance: more than 25 percent. Massachusetts, where a state health-insurance mandate has been in place for years, has th

Reported by Seattle Times 6 hours ago.

↧

Prevo Health Solutions Names Melissa Fox as Vice President of Marketing & Communications

Mrs. Fox to bring a seasoned background in Journalism, Communications, and Holistic Health Coaching to the Team.

San Juan Capistrano, California (August 29, 2013) (PRWEB) August 30, 2013

Prevo Health Solutions, the private club industry’s premier wellness experts with expertise in workplace wellness and member retention, today announced that Melissa Fox has been named Vice President of Marketing and Communications. Mrs. Fox will take lead in the development of strategic marketing and communications wellness campaigns and programs, as well as create turn-key wellness programs for clients in the club industry.

‘I am honored and blessed to have Melissa lead our Marketing and Communications efforts,’ said Founder and President Rick Ladendorf. ‘We worked well together for years at Eat Right America where Melissa served as Director of Health. I knew her background and expertise were exactly what we needed here at Prevo to help launch the CEO Pledge, America's Healthiest Clubs and our latest and very exciting project, the Health Care Self-Insured Captive. I’m very happy to be working work with Melissa again as she will help us to grow the business.’

Melissa brings a unique background that makes her a great fit for Prevo Health. She has over ten years of writing, marketing, and communications experience. Starting her career as a television reporter, and eventually becoming Marketing Manager at a prestigious Health Insurance Company, she brings a wealth of knowledge and expertise to Prevo Health.

Melissa is also a certified Holistic Health Coach, receiving her education at the Institute of Integrative Nutrition. In her practice, Melissa is a personal advocate to her clients, guiding them to improve their eating habits, understand their body better, feel confident in choosing and preparing better food, and to experience an increase in overall happiness in life. Her skills in this area will allow us to add additional value to our Private Club clients.

“I am very excited to be a on the Prevo Health Team,” Fox said. “This position allows me to use not only journalism, marketing, and communications skills, but also to use my expertise in health and nutrition to design outstanding programs and plans for our valued clients, as well as to act as a wellness consultant at Prevo Health. Above all, I’m thrilled to be a part of a company that is committed to transforming health one-person, one-club at a time. “

Mrs. Fox has already contributed to several projects at Prevo Health, and will serve as the lead Wellness Specialist as we roll-out the National CEO Pledge campaign.

About Prevo Health Solutions

Prevo Health Solutions, Inc. is the club industry’s premier wellness experts with expertise in workplace wellness and member retention. Or mission is to improve the overall health of the Private Club Industry through education and sharing of best practices. Our team consists of health professionals, certified nutrition & fitness experts, workplace wellness gurus and engagement specialists. We know what works in the workplace and we know the club industry. Prevo Health Solutions works with employers of all sizes to develop and execute custom wellness strategies which maximize engagement and participation. For more information call 888-321-1804 or visit http://www.prevohealth.com.

### Reported by PRWeb 1 hour ago.

San Juan Capistrano, California (August 29, 2013) (PRWEB) August 30, 2013

Prevo Health Solutions, the private club industry’s premier wellness experts with expertise in workplace wellness and member retention, today announced that Melissa Fox has been named Vice President of Marketing and Communications. Mrs. Fox will take lead in the development of strategic marketing and communications wellness campaigns and programs, as well as create turn-key wellness programs for clients in the club industry.

‘I am honored and blessed to have Melissa lead our Marketing and Communications efforts,’ said Founder and President Rick Ladendorf. ‘We worked well together for years at Eat Right America where Melissa served as Director of Health. I knew her background and expertise were exactly what we needed here at Prevo to help launch the CEO Pledge, America's Healthiest Clubs and our latest and very exciting project, the Health Care Self-Insured Captive. I’m very happy to be working work with Melissa again as she will help us to grow the business.’

Melissa brings a unique background that makes her a great fit for Prevo Health. She has over ten years of writing, marketing, and communications experience. Starting her career as a television reporter, and eventually becoming Marketing Manager at a prestigious Health Insurance Company, she brings a wealth of knowledge and expertise to Prevo Health.

Melissa is also a certified Holistic Health Coach, receiving her education at the Institute of Integrative Nutrition. In her practice, Melissa is a personal advocate to her clients, guiding them to improve their eating habits, understand their body better, feel confident in choosing and preparing better food, and to experience an increase in overall happiness in life. Her skills in this area will allow us to add additional value to our Private Club clients.

“I am very excited to be a on the Prevo Health Team,” Fox said. “This position allows me to use not only journalism, marketing, and communications skills, but also to use my expertise in health and nutrition to design outstanding programs and plans for our valued clients, as well as to act as a wellness consultant at Prevo Health. Above all, I’m thrilled to be a part of a company that is committed to transforming health one-person, one-club at a time. “

Mrs. Fox has already contributed to several projects at Prevo Health, and will serve as the lead Wellness Specialist as we roll-out the National CEO Pledge campaign.

About Prevo Health Solutions

Prevo Health Solutions, Inc. is the club industry’s premier wellness experts with expertise in workplace wellness and member retention. Or mission is to improve the overall health of the Private Club Industry through education and sharing of best practices. Our team consists of health professionals, certified nutrition & fitness experts, workplace wellness gurus and engagement specialists. We know what works in the workplace and we know the club industry. Prevo Health Solutions works with employers of all sizes to develop and execute custom wellness strategies which maximize engagement and participation. For more information call 888-321-1804 or visit http://www.prevohealth.com.

### Reported by PRWeb 1 hour ago.

↧

Rosanne Mahaney Joins CSG Government Solutions’ Healthcare and Human Services Practice

CSG Government Solutions, a national leader in government program modernization, today announced that Rosanne Mahaney has joined CSG’s Healthcare and Human Services practice.

Chicago, Illinois (PRWEB) August 30, 2013

CSG Government Solutions, a national leader in government program modernization, today announced that Rosanne Mahaney has joined CSG’s Healthcare and Human Services practice.

Prior to joining CSG, Ms. Mahaney was the Medicaid Director for the State of Delaware, managing the Medicaid, Chronic Renal Disease, Children’s Health Insurance, and State Prescription Assistance programs. Rosanne also led the critical planning efforts for the State’s Health Insurance Marketplace implementation.

"Rosanne’s experience leading the State of Delaware’s Medicaid program is a high-value asset to our Healthcare and Human Services practice," says Andrea Danes, Director of CSG’s Healthcare and Human Services practice. "She has extensive knowledge of the many challenges and opportunities our clients are facing in today’s dynamic healthcare environment."

CSG Government Solutions continues to increase its presence across the United States. The company deploys highly experienced teams and innovative methods, knowledge, and tools to help governments modernize complex program enterprises. CSG clients include 37 state governments, the U.S. Department of Health and Human Services, and large municipal governments.

Contact:

Andrea Danes

Director, Healthcare and Human Services

CSG Government Solutions

180 N. Stetson Ave

Suite 3200

Chicago, IL 60601

312.444.2760 Fax: 312.938.2191

adanes(at)csgdelivers(dot)com

About CSG Government Solutions:

CSG Government Solutions is a leading government operations consulting firm focused on helping states modernize critical program enterprises. Our highly experienced teams and industry-leading Centers of Excellence help governments leverage innovative technology and processes to meet the challenges of administering complex programs. Founded in 1997, CSG has established itself as a trusted adviser to government agencies across the U.S. Reported by PRWeb 2 hours ago.

Chicago, Illinois (PRWEB) August 30, 2013

CSG Government Solutions, a national leader in government program modernization, today announced that Rosanne Mahaney has joined CSG’s Healthcare and Human Services practice.

Prior to joining CSG, Ms. Mahaney was the Medicaid Director for the State of Delaware, managing the Medicaid, Chronic Renal Disease, Children’s Health Insurance, and State Prescription Assistance programs. Rosanne also led the critical planning efforts for the State’s Health Insurance Marketplace implementation.

"Rosanne’s experience leading the State of Delaware’s Medicaid program is a high-value asset to our Healthcare and Human Services practice," says Andrea Danes, Director of CSG’s Healthcare and Human Services practice. "She has extensive knowledge of the many challenges and opportunities our clients are facing in today’s dynamic healthcare environment."

CSG Government Solutions continues to increase its presence across the United States. The company deploys highly experienced teams and innovative methods, knowledge, and tools to help governments modernize complex program enterprises. CSG clients include 37 state governments, the U.S. Department of Health and Human Services, and large municipal governments.

Contact:

Andrea Danes

Director, Healthcare and Human Services

CSG Government Solutions

180 N. Stetson Ave

Suite 3200

Chicago, IL 60601

312.444.2760 Fax: 312.938.2191

adanes(at)csgdelivers(dot)com

About CSG Government Solutions:

CSG Government Solutions is a leading government operations consulting firm focused on helping states modernize critical program enterprises. Our highly experienced teams and industry-leading Centers of Excellence help governments leverage innovative technology and processes to meet the challenges of administering complex programs. Founded in 1997, CSG has established itself as a trusted adviser to government agencies across the U.S. Reported by PRWeb 2 hours ago.

↧

Experient Health Recommends Having Cholesterol Levels Checked in Living Well Blog Series

High cholesterol can affect people from early childhood through old age, while usually not showing any symptoms.

Richmond, Va. (PRWEB) August 30, 2013

High cholesterol can affect people from early childhood through older adult years, while usually not showing any symptoms, Experient Health reported in its latest post in the Living Well Blog series it launched this month on its web site.

A “simple blood test” can determine cholesterol levels and adult individuals should ask their physician about getting tested at least once every five years, Experient Health wrote. Children as young as 2-years-old should also be checked if they have elevated risk factors like being overweight or a family history of high cholesterol.

Cholesterol is a waxy, fat-like substance found in your body and many foods.

“Did you know your body needs cholesterol to function normally and you usually receive all you need from the food you eat? However, too much cholesterol is bad; it builds up in arteries, reducing blood flow and increasing the risk for heart disease and stroke,” according to the Living Well post.

“A simple blood test called a lipoprotein profile can measure your total cholesterol levels, including LDL (low-density lipoprotein, or “bad” cholesterol), HDL (high-density lipoprotein, or “good” cholesterol), and triglycerides.”

Experient Health’s Living Well Blog series covers topics ranging from healthy recipes, conservation, vaccination seasons, exercise tips, healthcare news and more.

ABOUT EXPERIENT HEALTH:

For years, Experient Health, a Virginia Farm Bureau company, has helped people find the right insurance coverage and get the most for their health care dollars. The Richmond, Va.-based group is dedicated to providing high quality health insurance options to customers in Virginia, Maryland, and Washington DC. As a result, its consultants, with an average of more than 20 years experience, are intimately familiar with the states’ provider networks, products and regulations.

Representing the top national insurance carriers, Experient Health provides customers with multiple policy options designed to meet wellness needs and financial requirements.

Experient Health grew out of Virginia Farm Bureau and is a “hometown agency” in that it operates a network of more than 100 offices. However, it boasts the resources and technology of larger firms.

Consultants are available online, via phone and through their offices.

Learn more at http://www.experienthealth.com, utilize the online health insurance quote calculator or contact a consultant directly at 855.677.6580. Reported by PRWeb 1 hour ago.

Richmond, Va. (PRWEB) August 30, 2013

High cholesterol can affect people from early childhood through older adult years, while usually not showing any symptoms, Experient Health reported in its latest post in the Living Well Blog series it launched this month on its web site.

A “simple blood test” can determine cholesterol levels and adult individuals should ask their physician about getting tested at least once every five years, Experient Health wrote. Children as young as 2-years-old should also be checked if they have elevated risk factors like being overweight or a family history of high cholesterol.

Cholesterol is a waxy, fat-like substance found in your body and many foods.

“Did you know your body needs cholesterol to function normally and you usually receive all you need from the food you eat? However, too much cholesterol is bad; it builds up in arteries, reducing blood flow and increasing the risk for heart disease and stroke,” according to the Living Well post.

“A simple blood test called a lipoprotein profile can measure your total cholesterol levels, including LDL (low-density lipoprotein, or “bad” cholesterol), HDL (high-density lipoprotein, or “good” cholesterol), and triglycerides.”

Experient Health’s Living Well Blog series covers topics ranging from healthy recipes, conservation, vaccination seasons, exercise tips, healthcare news and more.

ABOUT EXPERIENT HEALTH:

For years, Experient Health, a Virginia Farm Bureau company, has helped people find the right insurance coverage and get the most for their health care dollars. The Richmond, Va.-based group is dedicated to providing high quality health insurance options to customers in Virginia, Maryland, and Washington DC. As a result, its consultants, with an average of more than 20 years experience, are intimately familiar with the states’ provider networks, products and regulations.

Representing the top national insurance carriers, Experient Health provides customers with multiple policy options designed to meet wellness needs and financial requirements.

Experient Health grew out of Virginia Farm Bureau and is a “hometown agency” in that it operates a network of more than 100 offices. However, it boasts the resources and technology of larger firms.

Consultants are available online, via phone and through their offices.

Learn more at http://www.experienthealth.com, utilize the online health insurance quote calculator or contact a consultant directly at 855.677.6580. Reported by PRWeb 1 hour ago.

↧

↧

Michigan HIMSS Announces Fall Conference; CIOs from Major Health Organizations to Speak on Health IT

Michigan HIMSS (MI Health Information Management Systems Society) announces the speakers and location for their annual conference this year - “HIT: Building a Foundation for Healthcare Transformation in Michigan"

Lansing MI (PRWEB) August 30, 2013

The 2013 MI HIMSS conference, scheduled for September 10th and 11th has moved from Novi to a larger venue at the Inn at St. John’s in Plymouth Township in order to accommodate more attendees and sponsors.

“Last year was the first conference that the Michigan HIMSS has put on in several years,” said conference organizer and HIMSS board member, Mary Anne Ford. “We were a bit cramped for space. The larger facility at St. Johns will give us the extra capacity we need for additional vendor/sponsors, and participants.”

The speaker lineup includes opening day keynote Micky Tripathi, President and CEO of Massachusetts eHealth Collaborative, closing keynote Carla Smith, Executive Vice President of HIMSS, Adam Goslin, COO of High Bit Security, on Health IT Security, as well as HIPAA Omnibus rules, and Michigan issues, including the Health Insurance Exchange and Medicaid Meaningful Use. Breakouts will focus on success stories from health organizations that have implemented HIT solutions for the patients and practices.

The highlight of the first day is a CIO panel featuring Mary Alice Annecharico of Henry Ford Health Systems, Gary Harvey of Blue Cross Blue Shield, Patrick O’Hare of Spectrum Health, Donna Roach of Borgess/Ascension, and Marcus Shipley of Trinity Health. The panel will be moderated by Matt Roush, editor of the CBS online Technology Report, and well known technology commentator on WWJ-950 radio.

Current sponsors of the event include; Air-Watch, Alego Health CDW Healthcare, Cerner Corporation, Comcast, Commlink-Medisphere, Coretek, Elsevier, Enovate Medical, Great Lakes Health Information Exchange, High Bit Security, I.Comm, Logicalis, Michigan Health Connect, Morgan-Hunter Healthcare, OBIX, Secant Technologies, Sound Engineering, Sprint and Symantec. Sponsorship opportunities, which include display space at the event, are available. Additional sponsorship information is available on the Michigan HIMSS website.

Ms. Ford also clarified who can attend the conference. “Both HIMSS members and non-members are welcome to attend the conference, and there will be ample opportunity for networking with participants and conferring with our sponsors. Attendees can register at the Michigan HIMSS website.”

About HIMSS: MI HIMSS is a chapter of HIMSS Worldwide, a global, cause-based, not-for-profit organization focused on better health through information technology (IT). HIMSS leads efforts to optimize health engagements and care outcomes using information technology.. Founded in 1961, HIMSS Worldwide encompasses more than 52,000 individuals, of which more than two-thirds work in healthcare provider, governmental and not-for-profit organizations across the globe, plus over 600 corporations and 250 not-for-profit partner organizations, that share this cause. HIMSS Worldwide, headquartered in Chicago, serves the global health IT community with additional offices in the United States, Europe, and Asia. Reported by PRWeb 2 hours ago.

Lansing MI (PRWEB) August 30, 2013

The 2013 MI HIMSS conference, scheduled for September 10th and 11th has moved from Novi to a larger venue at the Inn at St. John’s in Plymouth Township in order to accommodate more attendees and sponsors.

“Last year was the first conference that the Michigan HIMSS has put on in several years,” said conference organizer and HIMSS board member, Mary Anne Ford. “We were a bit cramped for space. The larger facility at St. Johns will give us the extra capacity we need for additional vendor/sponsors, and participants.”

The speaker lineup includes opening day keynote Micky Tripathi, President and CEO of Massachusetts eHealth Collaborative, closing keynote Carla Smith, Executive Vice President of HIMSS, Adam Goslin, COO of High Bit Security, on Health IT Security, as well as HIPAA Omnibus rules, and Michigan issues, including the Health Insurance Exchange and Medicaid Meaningful Use. Breakouts will focus on success stories from health organizations that have implemented HIT solutions for the patients and practices.

The highlight of the first day is a CIO panel featuring Mary Alice Annecharico of Henry Ford Health Systems, Gary Harvey of Blue Cross Blue Shield, Patrick O’Hare of Spectrum Health, Donna Roach of Borgess/Ascension, and Marcus Shipley of Trinity Health. The panel will be moderated by Matt Roush, editor of the CBS online Technology Report, and well known technology commentator on WWJ-950 radio.

Current sponsors of the event include; Air-Watch, Alego Health CDW Healthcare, Cerner Corporation, Comcast, Commlink-Medisphere, Coretek, Elsevier, Enovate Medical, Great Lakes Health Information Exchange, High Bit Security, I.Comm, Logicalis, Michigan Health Connect, Morgan-Hunter Healthcare, OBIX, Secant Technologies, Sound Engineering, Sprint and Symantec. Sponsorship opportunities, which include display space at the event, are available. Additional sponsorship information is available on the Michigan HIMSS website.

Ms. Ford also clarified who can attend the conference. “Both HIMSS members and non-members are welcome to attend the conference, and there will be ample opportunity for networking with participants and conferring with our sponsors. Attendees can register at the Michigan HIMSS website.”

About HIMSS: MI HIMSS is a chapter of HIMSS Worldwide, a global, cause-based, not-for-profit organization focused on better health through information technology (IT). HIMSS leads efforts to optimize health engagements and care outcomes using information technology.. Founded in 1961, HIMSS Worldwide encompasses more than 52,000 individuals, of which more than two-thirds work in healthcare provider, governmental and not-for-profit organizations across the globe, plus over 600 corporations and 250 not-for-profit partner organizations, that share this cause. HIMSS Worldwide, headquartered in Chicago, serves the global health IT community with additional offices in the United States, Europe, and Asia. Reported by PRWeb 2 hours ago.

↧

GlobalSurance Launches Redesigned Health Insurance Website For Its Clients

GlobalSurance has launched a redesigned website to help clients more easily find the health insurance they need.

(PRWEB) August 30, 2013

GlobalSurance, one of the leading distributors for health insurance, announced today the launch of its redesigned website.

The designers at GlobalSurance gathered feedback on their previous website from their clients and incorporated it into the new design to help clients more easily find the health insurance they need.

“You simply have to think about the client first. Everything after that will follow in time” says Lead Web Designer Byan Shum. “We realize that health insurance is an investment that clients do not take lightly, and a high level of trust is of the utmost importance. Part of establishing that trust is listening to our clients in every way possible.”

The new site allows clients to quickly find any information they're looking for, whether it's information about a type of plan, an insurer, or the insurance policies of a specific country. “Our clients have told us that they want a quick, guided, but informative experience,” Shum added, “so that's what we've done.”

One of the main new features of the redesigned site is the interactive quote tool. GlobalSurance has over 48000 policies from 52 insurers, and the quote tool is a quick way for clients to navigate through the options and find the plan that suits their needs. The quote tool allows clients to filter the results by premium range, insurance provider, and benefits like maternity and dental.

As the first overhaul of its kind for GlobalSurance, the redesign marks a new chapter for the company, and clients are likely to appreciate the changes.

“Well we thought it was about time,” Shum laughed . “We recognize that GlobalSurance has a bright future ahead of it, and it seemed appropriate to give our clients an upgrade.”

To view GlobalSurance's new website, visit http://www.GlobalSurance.com. Reported by PRWeb 1 hour ago.

(PRWEB) August 30, 2013

GlobalSurance, one of the leading distributors for health insurance, announced today the launch of its redesigned website.

The designers at GlobalSurance gathered feedback on their previous website from their clients and incorporated it into the new design to help clients more easily find the health insurance they need.

“You simply have to think about the client first. Everything after that will follow in time” says Lead Web Designer Byan Shum. “We realize that health insurance is an investment that clients do not take lightly, and a high level of trust is of the utmost importance. Part of establishing that trust is listening to our clients in every way possible.”

The new site allows clients to quickly find any information they're looking for, whether it's information about a type of plan, an insurer, or the insurance policies of a specific country. “Our clients have told us that they want a quick, guided, but informative experience,” Shum added, “so that's what we've done.”

One of the main new features of the redesigned site is the interactive quote tool. GlobalSurance has over 48000 policies from 52 insurers, and the quote tool is a quick way for clients to navigate through the options and find the plan that suits their needs. The quote tool allows clients to filter the results by premium range, insurance provider, and benefits like maternity and dental.

As the first overhaul of its kind for GlobalSurance, the redesign marks a new chapter for the company, and clients are likely to appreciate the changes.

“Well we thought it was about time,” Shum laughed . “We recognize that GlobalSurance has a bright future ahead of it, and it seemed appropriate to give our clients an upgrade.”

To view GlobalSurance's new website, visit http://www.GlobalSurance.com. Reported by PRWeb 1 hour ago.

↧

Car Insurance Calculator - Special Online Rates As Low As $39/Month

Insurance-Online.us has been launched to provide consumers with low car insurance quotes.

(PRWEB) August 30, 2013

Insurance-Online.us, a new website has been launched that will truly give the user a simple way to get the best rates on auto, home, life or health insurance. It is much different than it used to be to find the best deals on these insurance products. This site offers potential customers local insurance companies to assist with the purchase of insurance policies. Click here to visit the website.

This website has been created with the customer in mind. The process is simple and effective. All web surfers need to do is get to the website and choose the type of insurance product that is desired. Once the insurance product is chosen, the customer simply has to put his or her area code into the online form. After that information is processed, the website will give the user several local insurance companies that can be contacted to begin the insurance policy process. This simplified way of doing business helps the customer to get legitimate insurance companies without having to spend countless hours online putting in personal information and waiting for a possible quote. The streamlined process increases the efficiency of buying insurance.

It used to be quite a hassle to find local insurance companies that will protect the customer from almost all of life's troubles. This newly created website is extremely user friendly and accurate. The site is continually updated to provide the most pertinent and relevant information possible. Remember that the site provides local insurance companies that provide coverage for auto, home, health and life insurance. In many cases, customers can roll all or some of these features together to get even better rates. All of these features are possibly simply by inputting a zip code.

Click here to learn more or apply for car insurance. Reported by PRWeb 32 minutes ago.

(PRWEB) August 30, 2013

Insurance-Online.us, a new website has been launched that will truly give the user a simple way to get the best rates on auto, home, life or health insurance. It is much different than it used to be to find the best deals on these insurance products. This site offers potential customers local insurance companies to assist with the purchase of insurance policies. Click here to visit the website.

This website has been created with the customer in mind. The process is simple and effective. All web surfers need to do is get to the website and choose the type of insurance product that is desired. Once the insurance product is chosen, the customer simply has to put his or her area code into the online form. After that information is processed, the website will give the user several local insurance companies that can be contacted to begin the insurance policy process. This simplified way of doing business helps the customer to get legitimate insurance companies without having to spend countless hours online putting in personal information and waiting for a possible quote. The streamlined process increases the efficiency of buying insurance.

It used to be quite a hassle to find local insurance companies that will protect the customer from almost all of life's troubles. This newly created website is extremely user friendly and accurate. The site is continually updated to provide the most pertinent and relevant information possible. Remember that the site provides local insurance companies that provide coverage for auto, home, health and life insurance. In many cases, customers can roll all or some of these features together to get even better rates. All of these features are possibly simply by inputting a zip code.

Click here to learn more or apply for car insurance. Reported by PRWeb 32 minutes ago.

↧

Wisconsin-Based Employee Benefits Administrator Makes Annual Inc. 500|5000 List & Named a Top 100 U.S. Insurance Company for Growth

Headquartered in Wisconsin, third party administrator (TPA) Cypress Benefit Administrators was named to Inc. magazine’s Inc. 500|5000 list for overall growth and received honors as a Top 100 Insurance Company in the United States. This recognition comes shortly after the TPA earned 2013 Business of the Year and Well Workplace awards.

Appleton, WI (PRWEB) August 29, 2013

With the 2013 Inc. 500|5000 list recently published, Cypress Benefit Administrators was ranked #38 in terms of growth for the Top 100 Insurance Companies in the United States. The third party administrator – headquartered in Wisconsin and operating from additional locations in Nebraska, Colorado and Oregon – grew 54% over the last three years and added 34 new jobs.

Cypress was also honored in the #65 position among the Top 100 Wisconsin Companies, and is the only TPA in the state to make the Inc. list.

In what can be considered three of the most challenging years on record in the history of the U.S. economy, this recognition comes after studying 2009-2012 data from private companies across the nation. It showcases those that were able to achieve growth amidst such hard times.

Inc. editor Eric Schurenberg explained the 500|5000 recipients as "hidden champions of job growth and innovation, the real muscle of the American economy.”

Cypress president and CEO, Tom Doney, said the Inc. honors come as a result of 13 years of hard work, creativity and innovation. “We started in 2000 as a team of eight people who had a vision to offer an affordable alternative to the traditional group insurance plan.” He added, “Today, we have grown to a staff of nearly 100, and are helping hundreds of clients achieve exactly what we first set out to do.”

Doney attributes much of the company’s continued growth to identifying – and implementing – a health benefit solution that works for each employer-client instead of one designed to accommodate the masses. He said, “With the services that make up The Cypress Solution, clients are able to build the individual employee benefit plan that best suits their own work population.”